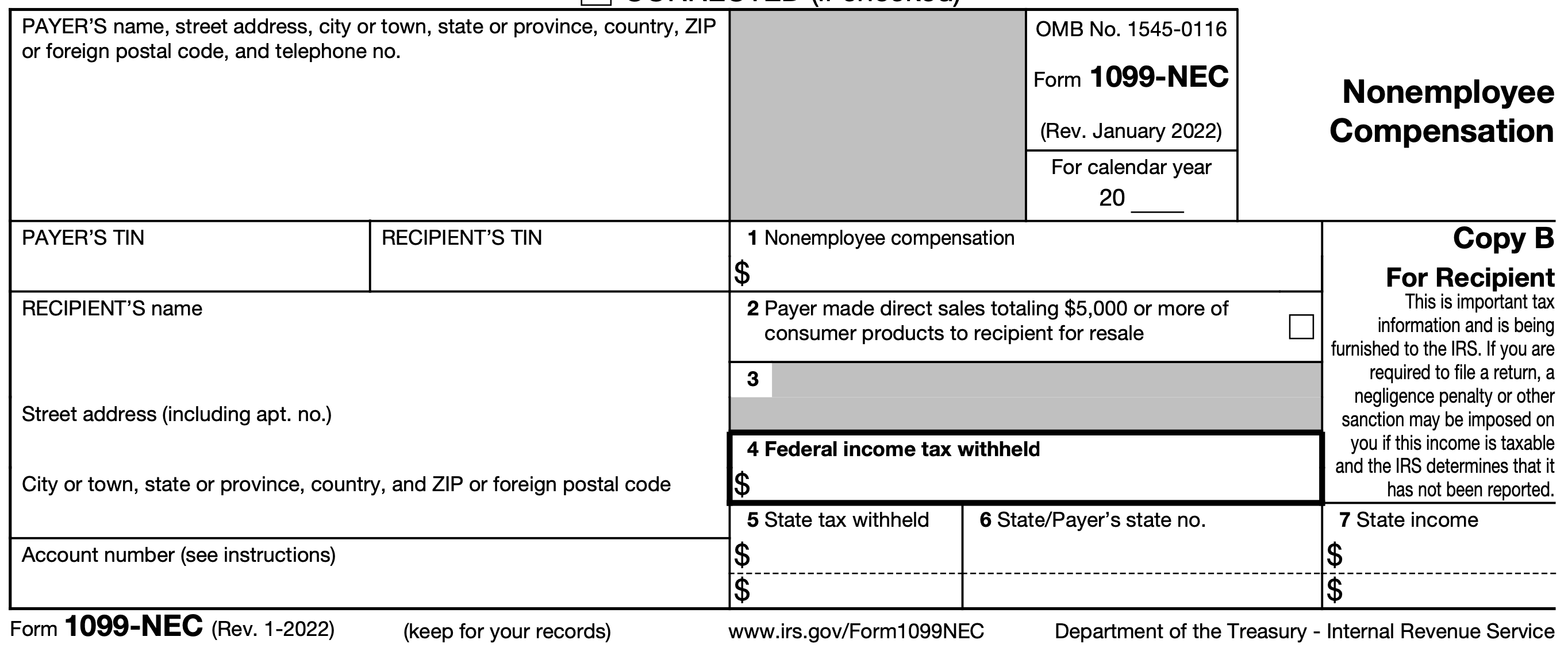

· learn all about irs form 1099, including what it is, how to fill it out accurately, tips for staying compliant, and strategies to simplify the process for your team. Businesses use different versions of the 1099 form to report payments made … There are various types of 1099s, depending on the type of income in question. Form 1099-misc is used to report rents, royalties, prizes … Information about form 1099-misc, miscellaneous information, including recent updates, related forms and instructions on how to file. Form 1099 is also used to report interest (1099-int), dividends (1099-div), sales proceeds (1099-b) and some kinds of miscellaneous income (1099-misc). Learn about the types and more. A 1099-misc form reports certain types of miscellaneous income, including rent, royalties, prizes and other payments. · information about form 1099-b, proceeds from broker and barter exchange transactions (info copy only), including recent updates, related forms and instructions on how … A 1099 form is a tax record that an entity or person — not your employer — gave or paid you money. In this guide, we’ll explain what a 1099 is, the … Blank 1099 forms and the related … · form 1099-b is used by brokers to report proceeds from the sale of securities on behalf of their clients, report proceeds from the sale of commodities, options, and futures … A 1099 form is an irs document used to report various types of income other than wages, salaries, and tips. · independent contractors receive 1099 forms from those they’ve rendered services to or transacted with, in the past year. Unlike a w-2 job, where taxes are withheld from each … 1099 employees are independent contractors or … We’re here to answer, “what are 1099s?” and other frequently asked questions about the form, like who receives a 1099, where to get 1099 forms, what the form reports for each situation, … · 1099 form importance receiving a 1099 means you’re on the hook for reporting that income on your tax return. · the term 1099 employee is somewhat misleading because individuals receiving a form 1099 are not technically employees. · you should receive most 1099 forms by the end of january, although the deadline is mid-february for a few. Income reported on a 1099 form is usually taxable, but not always. · by understanding the different types of 1099s and your responsibilities, you can approach the tax filing process with confidence.