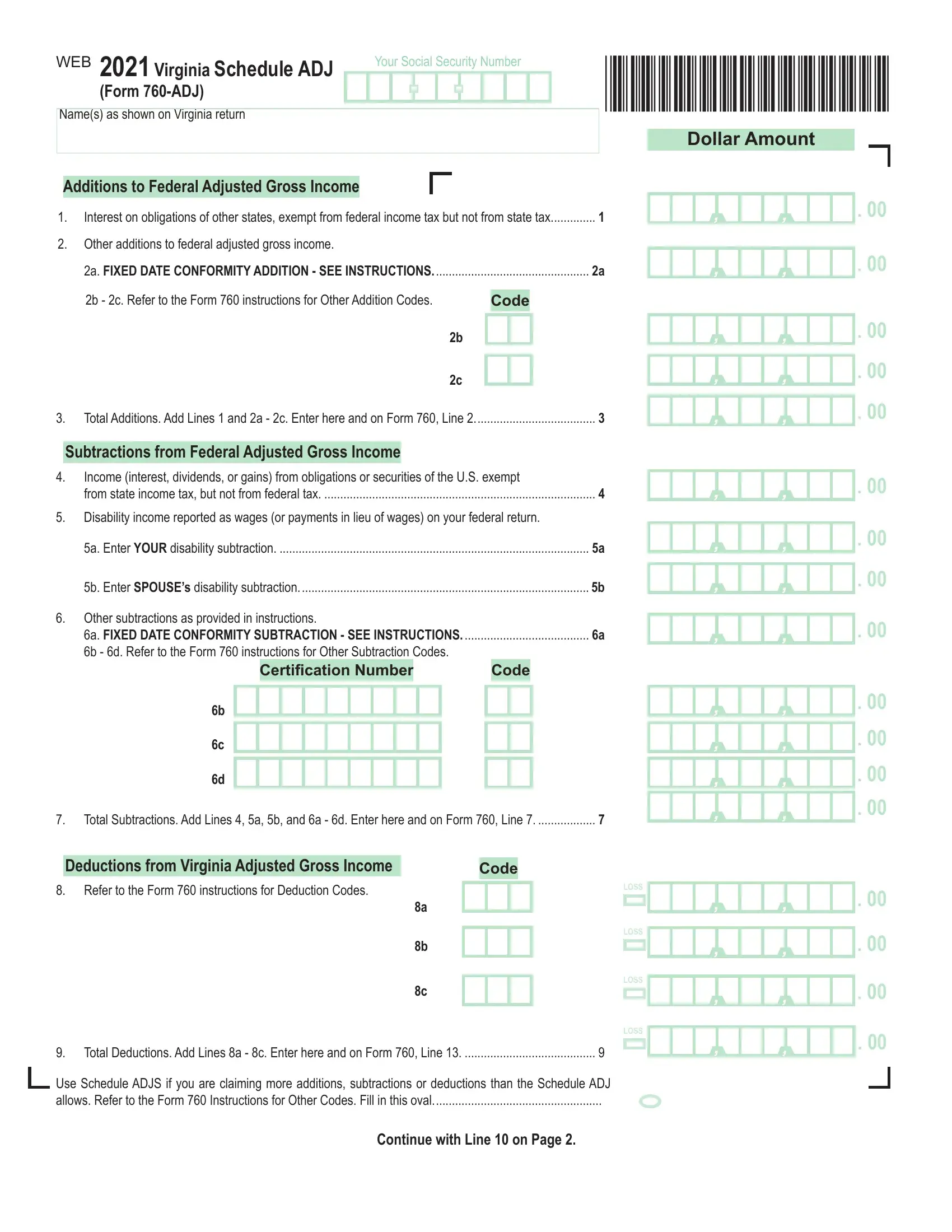

See line 9 and. Webdownload or print the 2023 virginia form 760 (resident individual income tax return) for free from the virginia department of taxation. The department of taxation will no longer send. 2022 form 760 resident individual income tax booklet. Webform 760 is the virginia tax return for residents who must report their income and calculate any taxes owed for the year 2023. Learn who should file, what to include, and how to file. Webfill in your tax information online just like completing a paper return. Prepare your virginia resident income tax return (form 760) and schedules. Perform basic math calculations. Webvirginia resident form 760 *va0760120888* individual income tax return. See line 9 and. Webget virginia tax filing reminders and tax news for individuals and businesses. Webschedule adj line instructions. Fixed date conformity update for 2022. Virginia’s fixed date conformity with the internal revenue code: Webvirginia’s fixed date conformity with the internal revenue code. Under emergency legislation enacted by the 2018 general assembly, virginia's date of. Virginia spouse tax adjustment. Websee the instructions for form 760, 760py or 763 for more on computing your estimated tax liability. If your estimated tax liability is greater than $150 you are required to make. Webaccording to the instructions for form 760, if you claimed a federal depreciation deduction and one or more of the depreciable assets received the special 30% or 50% bonus. Webresidents of virginia must file a form 760. (a person is considered a resident if they have been living in virginia for more than 183 days in a calendar year). The following forms and schedules are prepared for the virginia return: Form 760cg virginia individual income tax return. Webi/we are uninsured and authorize the sharing of certain information from form 760 and schedule adj (as described in the instructions) with the department of medical. Webi/we authorize the sharing of certain information from form 760 and schedule hci (as described in the instructions) with the department of medical assistance services. Webcomplete form 760, lines 1 through 9, to determine your virginia adjusted gross income (vagi). If the amount on line 9 is less than the amount shown below for your Open form follow the instructions. Easily sign the form with your finger. Virginia has a progressive tax structure, with four income tax rates ranging from 2% to 5. 75%.