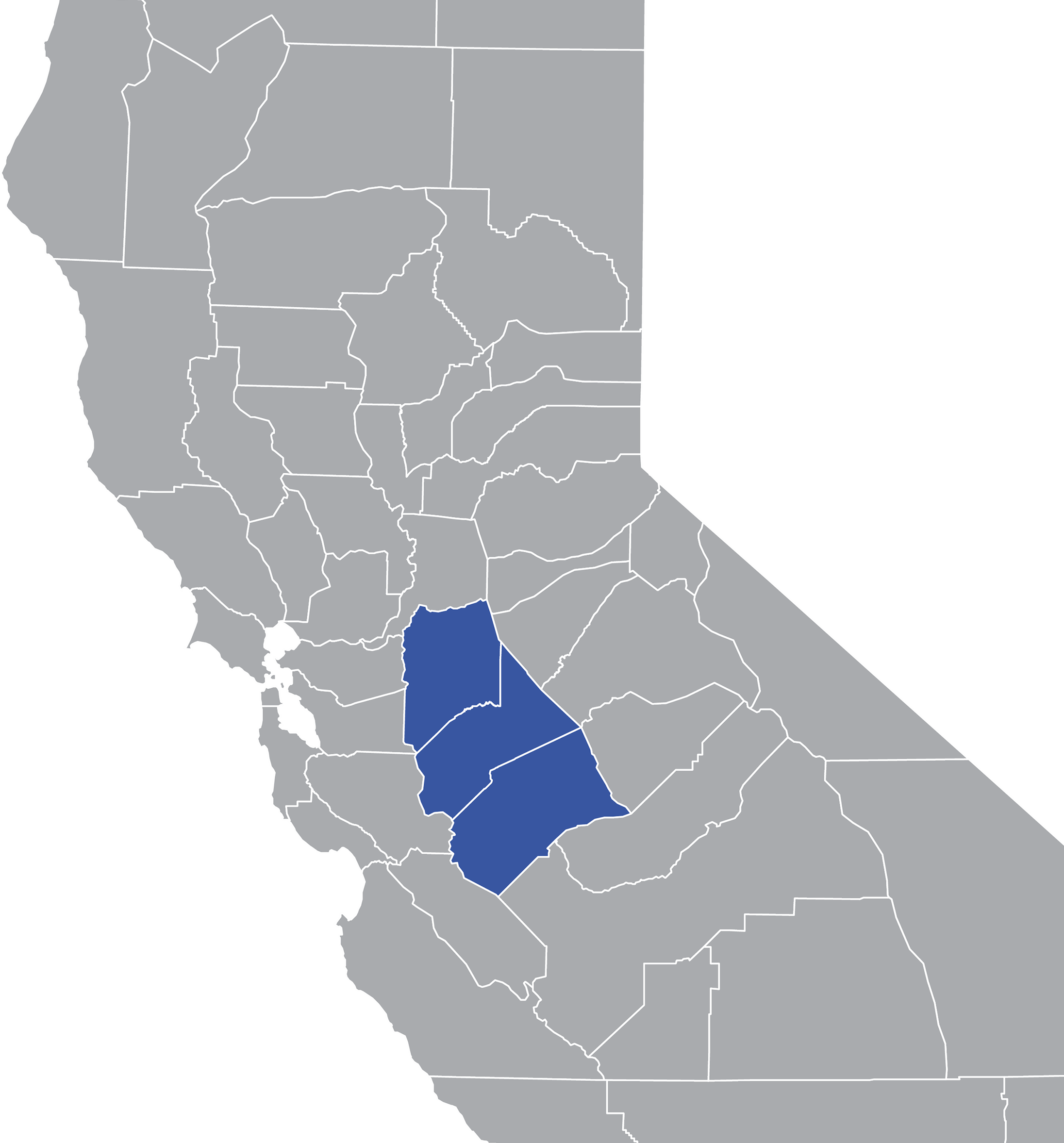

You may be eligible for an exemption of up to $7,000 off your property’s assessed value, resulting in a property tax savings of approximately $70. Webthis senior exclusion benefit may provide relief by allowing seniors to upgrade their lifestyle in a new home without increasing their property taxes. The home must have been the. Webclaim for homeowners’ property tax exemption. If eligible, sign and file this form with the assessor on or before february 15 or on or before the 30th day following. Webif you own a home in san joaquin county, you may be eligible for a homeowner’s exemption on your property tax bill. This exemption reduces the assessed. Webfiling is free for the homeowner's exemption. You may be eligible for an exemption of up to $7,000 off the property’s assessed value, resulting in a property tax savings of approximately $70 annually if you own and occupy your home as your.