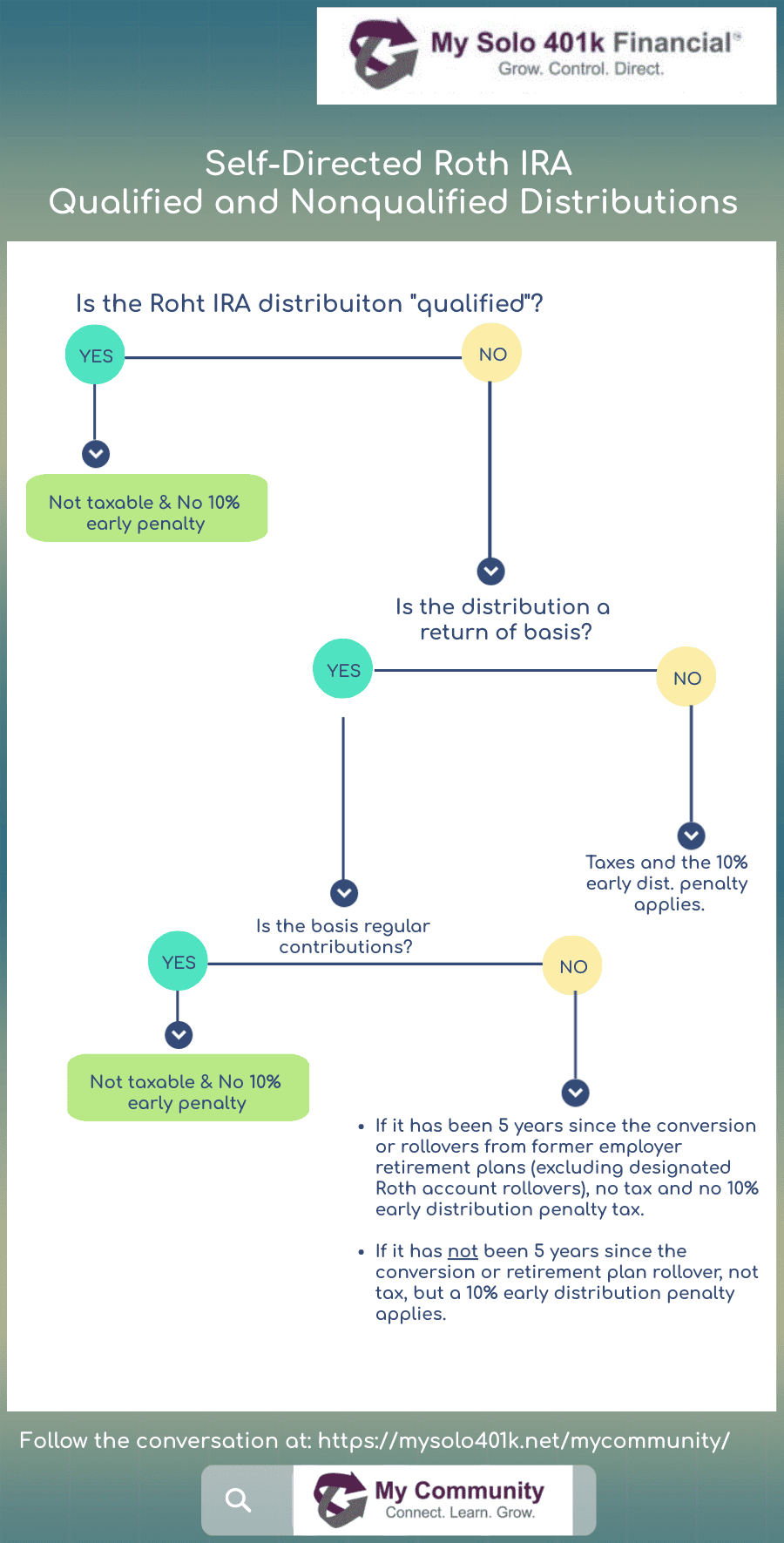

· roth ira contributions can be withdrawn at any time without tax or penalty. The five-year rule applies regard…qualified distributions are tax-free and penalty-free. The taxes and penalties might be avoided during certain situations, including … · navigate roth ira withdrawals by learning when you are eligible to make a withdrawal, tax matters, whether you may face penalties, and exceptions to the rules. Roth iras offer flexible withdrawal options, but … Made on or after the date you turn 59½ 2. If you are not sure whether a distribution will be qualified, you should … A roth ira distribution is considered qualified if your account meets the five-year rule andthe withdrawal is: Qualified distribution requires a 5-year period beginning … Roth ira earnings can incur early withdrawal taxes and penalties, depending on your age and the … With a roth ira, contributions are not tax-deductible, but earnings can grow tax-free, and qualified withdrawals are tax- and penalty-free. Taken because you have a permanent disa… · when you’re considering withdrawals from your roth ira, there are several important rules to keep in mind that will help avoid tax penalties and maximize your benefits. · roth ira distributions on contributions can be taken at any time, both tax- and penalty-free. · when you invest in a roth ira, one of the most important things to understand is how and when you can withdraw your money. · learn about roth iras, a type of retirement account that offers tax-free qualified distributions. There are limits to the amount you can contribute to a roth ira and your income can also exclude you from contributing if you exceed the thresholds set by the internal revenue service (irs). The amount youre allowed to contribute annually to a …you can generally withdraw your earnings without owing any taxes or penalties if youre at least 59½ years old and its been at least five years since you first contributed to your roth ira. If you are considering taking a distribution from your roth ira, it is important to understand the tax and penalty implications. · roth ira core rules unchanged through 2024 and into september 2025, keeping tax-free withdrawal framework intact. This is known as the five-year rule. Find out the rules, limits, and differences between roth iras and designated roth … Roth ira withdrawal and penalty rules vary depending on …