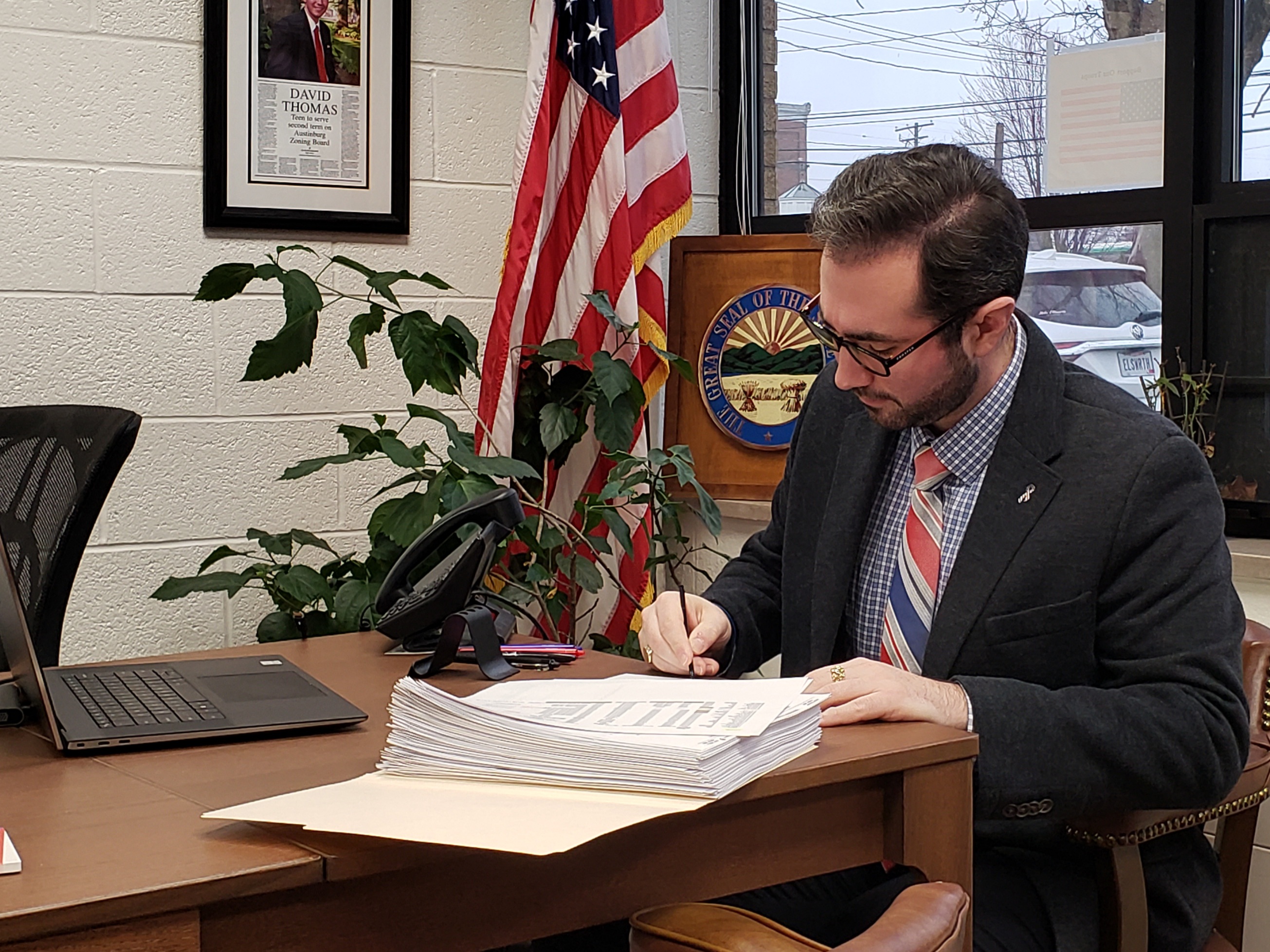

— ashtabula county will have our triennial update in 2023 which will change values on tax bills in 2024. Unlike the 2020 mass revaluation, the 2023 triennial update has no field. Residents are being mailed. The ashtabula county assessor is responsible for appraising real estate and assessing a property tax on properties located in ashtabula. To research property values, taxes and payments, use property search on the auditor's website. Select any of the property search options (address, owner,. — jefferson — ashtabula county auditor david thomas often gets asked the question, “what will my property taxes be like next year?” thomas doesn’t mind the. — the auditor's office will be relocating for asbestos removal from august 9th to the second week of september or sooner. Wednesday, may 19, 2021 *property transfer. The two things that can change the amount due are a difference in the property valuation or tax rate. How is the value created? What is the purpose of the ashtabula county revaluation program? Why should properties be equalized? What causes property values to change?. — rome — tempers flared last week as ashtabula county auditor david thomas took questions from 35 residents about the new property values and tax amounts. The auditor’s office role in your tax bill is to assess the market value on your property and calculate your taxable amount based on your location and tax district. Get a complete overview of all of the factors that determine your selected property's tax bill with a full property report. Plus, receive a detailed rundown of property characteristics, ownership. View the responsibilities of the county auditor office, contact information, helpful links, and transparent documents. Find transparent documents the county auditor and. You should pay your property taxes within the required time. You can pay your property taxes by various methods including check, money order, cashier’s check, credit card/debit card, e. How to appraise the properties? There are more than 78,000 parcels in ashtabula county. According to ohio law, the auditor should reappraise all properties every six years and make. — the auditor’s office receive the mandate to increase ashtabula county’s overall residential property value by 32 percent following the strong real estate market over the past. Our ashtabula county property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax burden compares to the average. Welcome to the ashtabula county auditor's map viewer. We assume no responsibility for the consequences of inappropriate use or interpretation of the data. Any person that relies on.